Positioning your portfolio amid uncertainty

Share

Developments over recent weeks have proved a wake-up call to markets after a complacent start to the year.

The trigger was the failure of Silicon Valley Bank and other US regional banks, followed by the Credit Suisse crisis. In both Europe and the US, the subsequent repricing of core yields and changes to market expectations regarding central bank actions have been significant. Bond volatility reached its highest levels since the Great Financial Crisis of 2008, while equity volatility also spiked, although to a lesser extent.

Amid this heightened uncertainty, investors may wish to favour a more defensive stance in their portfolios.

To this end, we have set out below some ideas for consideration:

1. Look at short-term bonds as a way to reduce portfolio risk

Swift action from central banks, to reinforce liquidity access and stabilise markets, indicates that they are taking this turmoil seriously, while at the same time continuing to focus on inflation with rate hikes. They will now be even more data dependent, with little or no policy guidance. This, in turn, will likely keep bond volatility high as inflation is still above target levels.

In this environment, short-term bonds may help reduce portfolio risk while the positive yield they provide means they have scope to outperform cash.

2. Consider adding diversification and protection with gold

Looming risks around economic growth and still-high inflation underline the importance of gold as a safe haven asset. Gold has long been lauded as a potential hedge against uncertainty and, in the toughest of times, has provided a welcome diversification benefit that few assets can match.

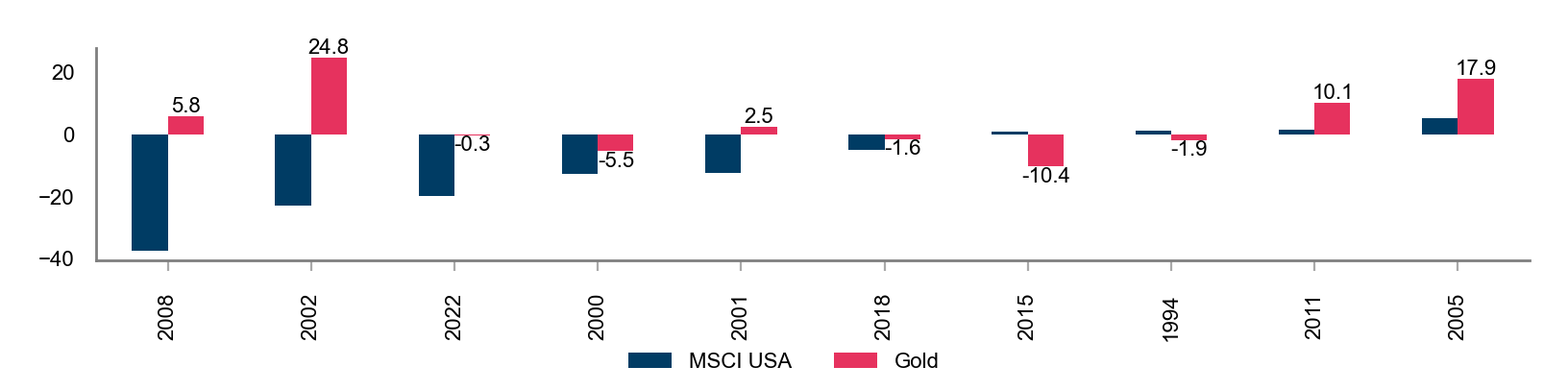

Gold returns during tough times

Total Return of Equities and Gold (in %, US Dollar) during the 10 worst years observed in the last 30 years

Source: Bloomberg, Amundi. Data as at 31/03/2023. The performance of each asset class is represented by its corresponding representative MSCI (for Equity) and Gold is represented by the gold price return. Past performance is not a reliable indicator of future performance.

ETF investment options for consideration

The LYXOR NYSE ARCA GOLD BUGS (DR) UCITS ETF provides exposure to short-term movements in the price of gold by including companies that do not hedge their gold production beyond 1.5 years.

3. Think about using longer-dated treasuries to mitigate US recession risks

The recent uncertainties and the prospect of a further slowdown in economic activity provided for a recovery in US Treasuries over the past month. Market anticipations of rate cuts as early as this summer also acted as a strong support for longer duration bonds. In addition, although uncertainty remains as to how the developments of the past few weeks will weigh on underlying economic growth, globally speaking, we believe that central banks are set to pursue a less aggressive course.

Exploring US government bonds may be a way to provide some stability to portfolios at a time of tightening financial conditions in the markets and lending standards in the economy.

Source: Bloomberg, NBER, Amundi. Data as at 23/03/2023.

Past performance is not a reliable indicator of future performance

Knowing your risk

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (‘KID’) or Key Investor Information Document (“KIID”) for UK investors and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com or lyxoretf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

CREDIT WORTHINESS – The investors are exposed to the creditworthiness of the Issuer.

AMUNDI PHYSICAL GOLD ETC (the “ETC”) is a series of debt securities governed by Irish Law and issued by Amundi Physical Metals plc, a dedicated Irish vehicle (the “Issuer”). The Base Prospectus, and supplement to the Base Prospectus, of the ETC has been approved by the Central Bank of Ireland (the “Central Bank”), as competent authority under the Prospectus Directive. Pursuant to the Directive Prospective Regulation, the ETC is described in a Key Information Document (KID), final terms and Base Prospectus (hereafter the Legal Documentation). The ETC KID must be made available to potential subscribers prior to subscription. The Legal Documentation can be obtained from Amundi on request. The distribution of this document and the offering or sale of the ETC Securities in certain jurisdictions may be restricted by law. For a description of certain restrictions on the distribution of this document, please refer to the Base Prospectus. The investors are exposed to the creditworthiness of the Issuer.

IMPORTANT INFORMATION

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006. This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933. The information and forecasts are inevitably partial, provided on the basis of market data observed at a particular moment, and are subject to change. This document may contain information from third parties that do not belong to Amundi (“Third Party Content”). Third Party Content is provided for information purposes only (for illustration, comparison, etc.). Any opinion or recommendation contained in Third Party Content derives exclusively from these third parties and in no circumstances shall the reproduction or use of those opinions and commendation by Amundi AM constitute an implicit or explicit approval by Amundi AM. Information reputed exact as of March 2023.

Reproduction prohibited without the written consent of the Management Company. Amundi ETF designates the ETF business of Amundi Asset Management. This Document was not reviewed/stamped/approved by any Financial Authority. Amundi ETF funds are neither sponsored, approved nor sold by the index providers. The index providers do not make any declaration as to the suitability of any investment. A full description of the indices is available from the providers. This document is being issued inside the United Kingdom by Amundi which is authorised by the Autorité des marchés financiers and subject to limited regulation by the Financial Conduct Authority (“FCA”). Details about the extent of regulation by the FCA are available on request. This document is only directed at persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook. The investments described herein are only available to such persons and this document must not be relied or acted upon by any other persons. This document may not be distributed to any person other than the person to whom it is addressed without the express prior consent of Amundi.

Amundi Asset Management, French “Société par Actions Simplifiée” - SAS with capital of €1,143,615,555 - Portfolio Management Company approved by the AMF (French securities regulator) under no. GP 04000036 - Registered office: 91-93 boulevard Pasteur, 75015 Paris - France. 437 574 452 RCS Paris.